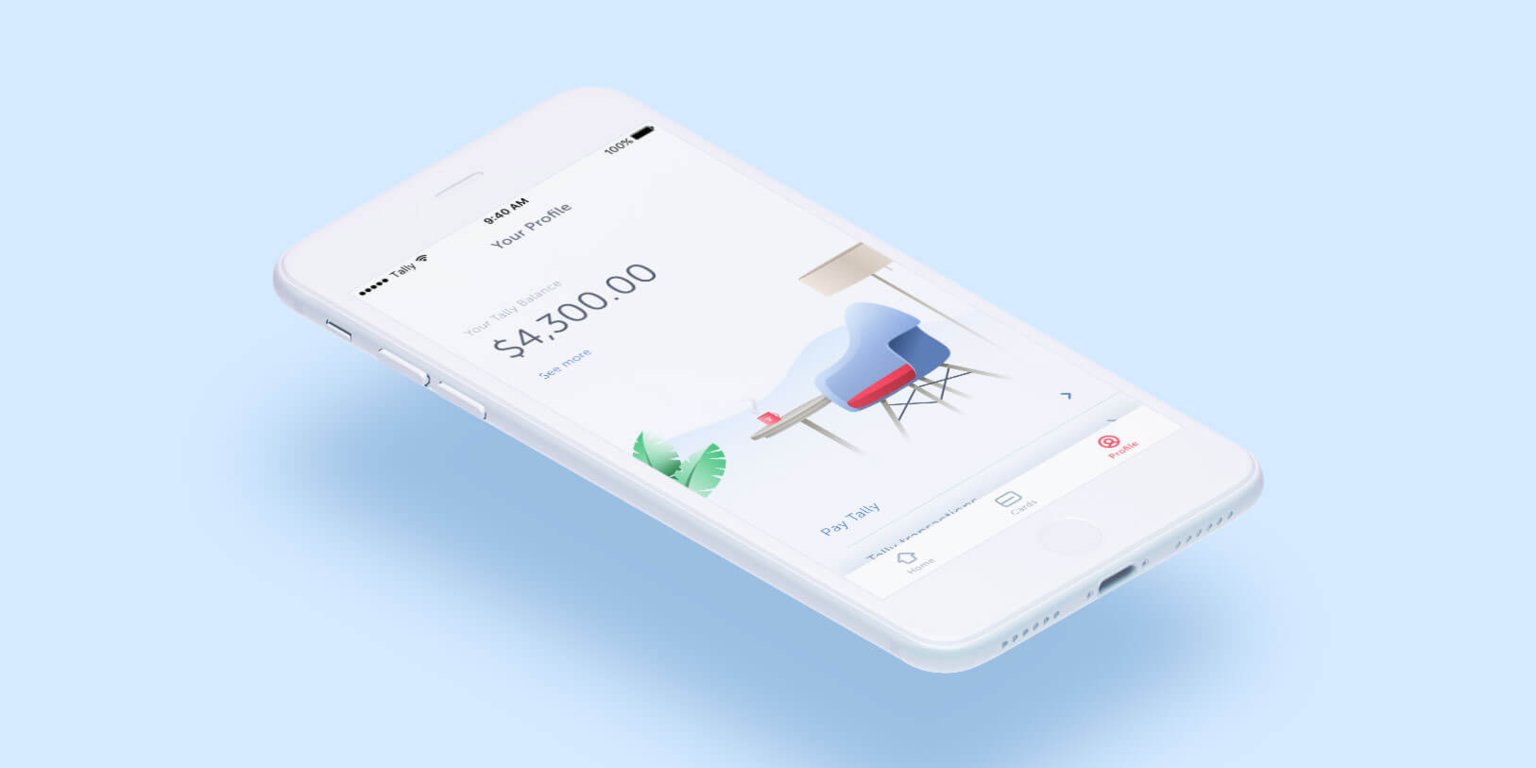

New App Helps You Manage Your Credit Card Debt

If you are trying to manage your credit card debt, then there is an app that can help you. There is a new app called Tally, which was created by Jasper Platz and Jason Brown. Tally allows you to analyze your credit. You will be able to store information about your credit cards, credit score and lenders.

After the information is stored, your spending habits will be analyzed. If you have good credit, then you may be able to get your own credit line from Tally. You will be able to consolidate your debt, which will allow you to pay it off faster.

Tally is a credit card manager. You will be able to keep track of all of your credit card information in one place. This will make it easier for you to make payments on time. Making payments on time helps people save money. You will not have to pay late fees. You will also not have to pay higher interest rates.

Tally also helps you manage your debt by analyzing your credit card uses. You can use Tally to determine how long it will take you to pay off your credit cards if you just make the minimum payment. Not only does Tally use your APR to give you an expected payoff date but it also analyzes your spending habits.

Furthermore, the Tally credit line can help you improve your credit score. The credit line is not a personal loan. It is a revolving line of credit. You do not have a time limit to pay it off. If you use a certain amount of credit, then it will become available to you once you make a payment on it. Keep in mind that you need to have a 660 credit score to qualify for this line of credit.