Matt Badiali is a skilled expert who regularly invests in various metals, and he also helps investors who frequently buy numerous commodities. The specialist has examined many silver mines, mines that contain gold, sizable oil fields, large mines that offer tin and facilities that process various metals. The expert has evaluated numerous types of strategies that sizable companies utilize, and the investor regularly studies geological information that can affect the values of certain metals, the techniques that many businesses use, the revenue that specific mines generate and the availability of certain commodities.

Matt Badiali earned an undergraduate degree from Penn State University, and when he attended Florida Atlantic University, he mainly studied geology and Earth science. After Matt received a graduate degree from Florida Atlantic University, many instructors described his intelligence, his work ethic and various valuable skills that impressed the instructors.

The Value of Silver

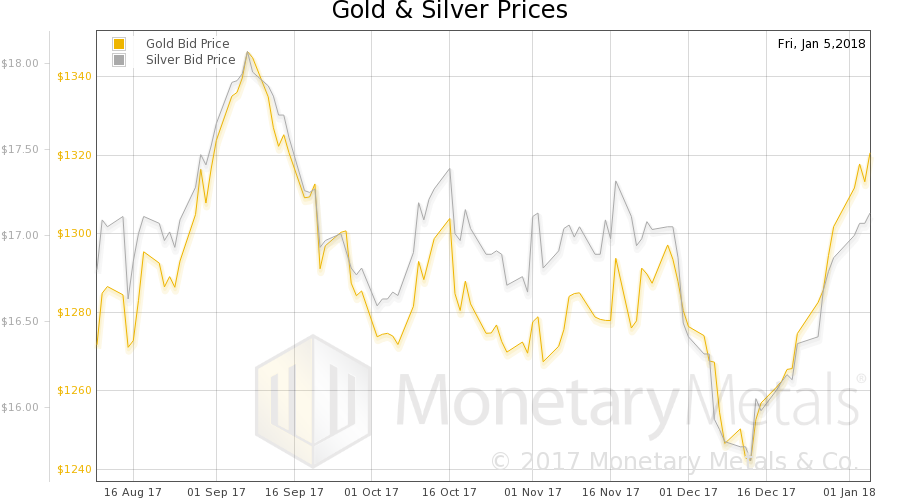

The expert frequently advises other investors who may buy gold, silver, oil, tin, cobalt and natural gas, and during the last 10 years, more than 20 sizable companies have sought his advice. Matt Badiali strongly encourages his clients to invest in silver, and currently, each ounce of silver has a market value of around $14. Since October 2016, the value of silver has decreased by more than 21 percent, and during the last three months, the price of an ounce of silver has stabilized. Numerous reports have estimated that the worth of silver may tremendously increase during the next two years. Many experts believe that silver will remain relatively inexpensive for two months, yet various surveys have indicated that the overall demand may substantially rise throughout the next six months.

Examining the Demand

Generally, the value of silver may be tremendously affected by various types of companies, and many of these businesses manufacture automobiles, electronics, devices that utilize solar energy, medical equipment, electrical conductors, LEDs and items that contain glass. While numerous companies buy large amounts of silver, the availability of silver may slightly decrease because of the rising demand, yet Matt Badiali has explored various mines that could substantially increase the quantity of available silver. The expert has visited Switzerland, Turkey, Singapore, Hong Kong, Australia and Indonesia, and he regularly studies the techniques that miners utilize, components that could improve drills, equipment that may create advanced maps and the overall efficiency of the silver mines.

Evaluating Silver and Gold

In September 2018, 162 ounces of silver may have a value that is equivalent to the price of 2 ounces of gold. During the last five years, the ratio has tremendously increased, and the ratio has not reached this level since 1995. Consequently, investors can easily buy large amounts of silver if they sell relatively small quantities of gold; however, some experts have indicated that the ratio may significantly decrease before January 2019.

Examining the Behaviors of Numerous Investors Who Have Bought Silver

Matt Badiali has indicated that exchange-traded funds currently contain more than 670 million ounces of silver, and according to various economic forecasts, exchange-traded funds may have 850 million ounces of silver before 2032. Generally, these investments augment the overall demand for silver, yet some investors also increase the long-term worth of silver by reducing the supply of silver.

Evaluating Companies That May Buy Large Amounts of Silver

Various investors have indicated that environmentally friendly devices will require more than 1.5 million ounces of silver during the next 12 years. Numerous companies may add at least 900 million ounces of silver to equipment that can utilize solar energy, and according to multiple reports, this industry is swiftly expanding. Before 2035, more than 275 million Americans may own numerous devices that use solar energy, and one expert indicated that at least 85 percent of these products will contain silver.

Utilizing Silver and Improving the Cleanliness of Medical Centers

Silver is an antibacterial compound, and some individuals regularly ingest small amounts of silver in order to strengthen their immune systems. During the last 20 years, the managers of many medical centers have placed tiny quantities of silver on their floors, and sometimes, physicians add a coating of silver to certain types of equipment. Furthermore, some companies have created eye drops and dental formulas that contain silver, and numerous studies have shown that these liquids can significantly decrease the risk of infections.

Examining Automakers That Buy Silver

Generally, many automobiles feature advanced electronics that have significant amounts of silver. Numerous automakers also create bearings that are made of silver. When an engine is functioning, the main bearings allow the crankshaft to spin, and unlike some metals, silver can easily withstand the effects of high temperatures in sizable engines. Multiple experts have determined that silver may significantly improve the smoothness of other components that swiftly move. Moreover, the metal can sometimes absorb oxygen, so silver may prevent oxidation and decrease the effects of certain byproducts that engines generate.

Manufacturing Decorative Items That Contain Silver

During the last two years, the worth of gold has significantly increased, and numerous reports have suggested that the value of gold may swiftly rise by more than 10 percent. Consequently, many companies are manufacturing items that contain silver, and some businesses may create rings, bracelets, earrings and various types of necklaces. According to multiple experts, these companies will eventually require much larger quantities of silver, and during the next two years, the overall demand may rise by more than 30 percent.

Understanding the Strategies of Certain Companies That Manage Mines

In January 2009, numerous mining companies experienced a downturn that reduced the productivity of five major businesses, yet since March 2012, most mining companies have experienced tremendous recoveries, purchased new equipment, hired experienced engineers who can study various types of terrain and opened new mines. Matt has indicated that many businesses may significantly increase productivity before January 2020, and certain companies could utilize cutting-edge drills that may reduce downtime, decrease the costs of mining and help miners who are implementing new strategies.

In January 2009, numerous mining companies experienced a downturn that reduced the productivity of five major businesses, yet since March 2012, most mining companies have experienced tremendous recoveries, purchased new equipment, hired experienced engineers who can study various types of terrain and opened new mines. Matt has indicated that many businesses may significantly increase productivity before January 2020, and certain companies could utilize cutting-edge drills that may reduce downtime, decrease the costs of mining and help miners who are implementing new strategies.

Studying the Benefits of New Technology and Examining Mines That Contain Silver

Some companies regularly use cutting-edge devices that can create interactive maps, and these images could indicate the density of certain rocks, the composition of sediment, the depth of a cavern or the configurations of various formations. The equipment can also estimate the quantity of silver that a specific area contains, and consequently, the devices may significantly reduce costs that are associated with exploration.

Examining the Predictions of Other Experts

Keith Neumeyer is the CEO of First Majestic Silver, and in March 2018, the experienced investor indicated that the price of an ounce of silver may reach $130. The expert suggested that the increasing value of gold could cause more investors to buy silver, and he believes that the rising demand has not fully affected the worth of silver. His predictions coincide with the economic forecasts that Matt Badiali has created, and once the value of silver rapidly rises, the price of an ounce of silver may exceed $35 until 2065.

For more information on Matt Badiali follow him on Facebook, Twitter, YouTube or visit his website: https://freedomchecks.com/.