2022 was a watershed moment for the fintech sector, and with the globe still reeling from the pandemic, customers’ access to financial services everywhere and at all times is more important than ever. That’s why you must keep a close eye on the most recent changes and news about what is coming in the future. Let’s look at four fintech trends to watch out for.

Digital Banking

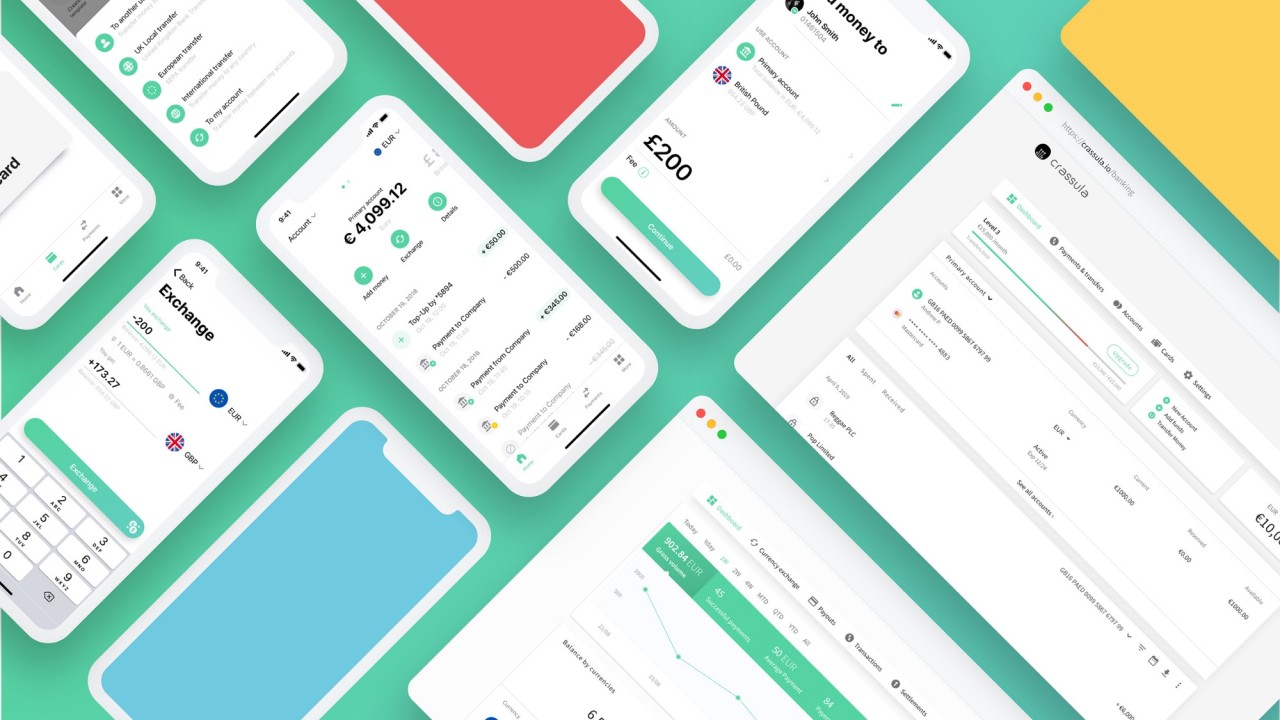

Bank closures seem to be rampant because of changing customer patterns triggered by the pandemic. Online banking offers a better consumer experience while also providing efficient and faster services. The best part is that online banking is more than just being cashless and paperless; the core technologies have significantly helped in the shift from a centralized conventional banking system to a more decentralized, technology-driven one.

Blockchain Technology

Blockchain is without a doubt the most substantial financial invention for digital transactions since its governance is decentralized, implying that it cannot be managed by a single individual, corporation, bank, or government. Despite the fact that firms are worried about the security of this cutting-edge fintech, Blockchain’s rising adoption as a means of establishing a secure online ledger cannot be overlooked.

White Label Fintech

White labeling is the next popular financial trend that you shouldn’t overlook. In brief, white label items are created by a supplier and then rebranded before being traded. Financial management is a complex subject. White label financial solutions make it simple for businesses of all sizes to set up a worldwide payment gateway. This creates a win-win scenario because it gives the distributor a broader customer base while reducing the reseller’s upfront launch expenses.

Voice Payments

No one could have foreseen the speed with which online banking would take off when it first began. Expect speech to rapidly become a trusted method for consumers and companies to complete everyday financial activities. Consumers will gain from the comfort of speaking rather than typing to rapidly obtain the information they want. Advances in language processing, interpretation, and creation will enable clients to utilize speech for financial transactions in a method that makes them feel as though they’re dealing with an actual teller.

Fintech trends will undoubtedly change after this year. Last year’s events broadened our grasp of what an online economic system will look like in the future. Maintain a competitive edge by influencing the future of your financial planning by keeping these newest fintech ideas on your radar.